New York labor officials on Thursday called on the state’s employers to provide workers with the information they need when filing for unemployment benefits, including employer registration numbers, federal employer identification numbers, and full names and addresses of employers.

The missing information has been partially attributed to the backlog of claims at the Department of Labor during the coronavirus pandemic and subsequent economic crisis.

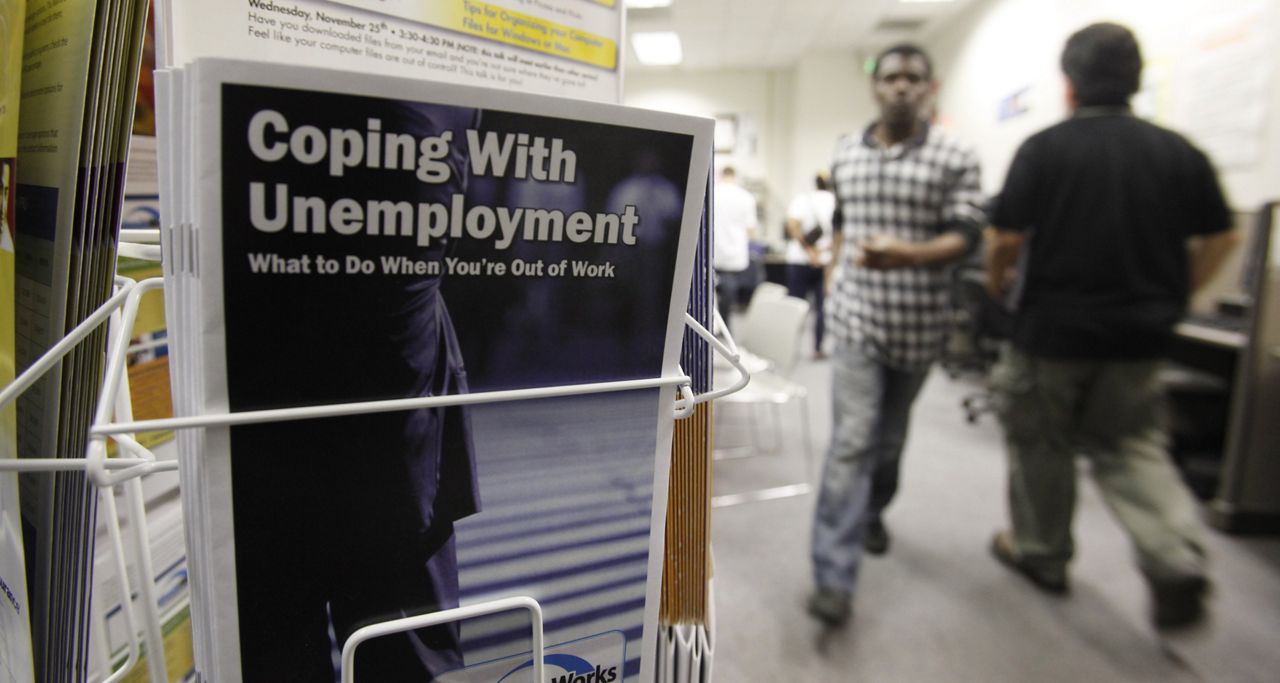

Millions of people have filed unemployment claims in March and April as businesses shutter and furlough or lay people off.

“Applying for unemployment benefits can seem daunting and overwhelming, especially during a public health crisis, and we all have a responsibility to help ease the burden on New Yorkers who are out of work,” New York State Labor Commissioner Roberta Reardon said. “The number one reason New Yorkers’ applications are incomplete is because they are missing Federal Employer Identification Numbers — and today we are reminding businesses they are legally required to provide this information so former employees can easily file complete applications and access the benefits they deserve.”

RELATED | Unemployment Benefits Reach $3.1B in New York

State officials sent a guidance to 320,000 New York-based employers to provide the information that’s requested when a person files for benefits.

New Yorkers are asked for the information which is used to confirm wage history. Usually that is found on a W2, a document that a person doesn’t necessarily have readily available.

So far more than $3 billion in unemployment benefits have been paid out by New York during the pandemic.