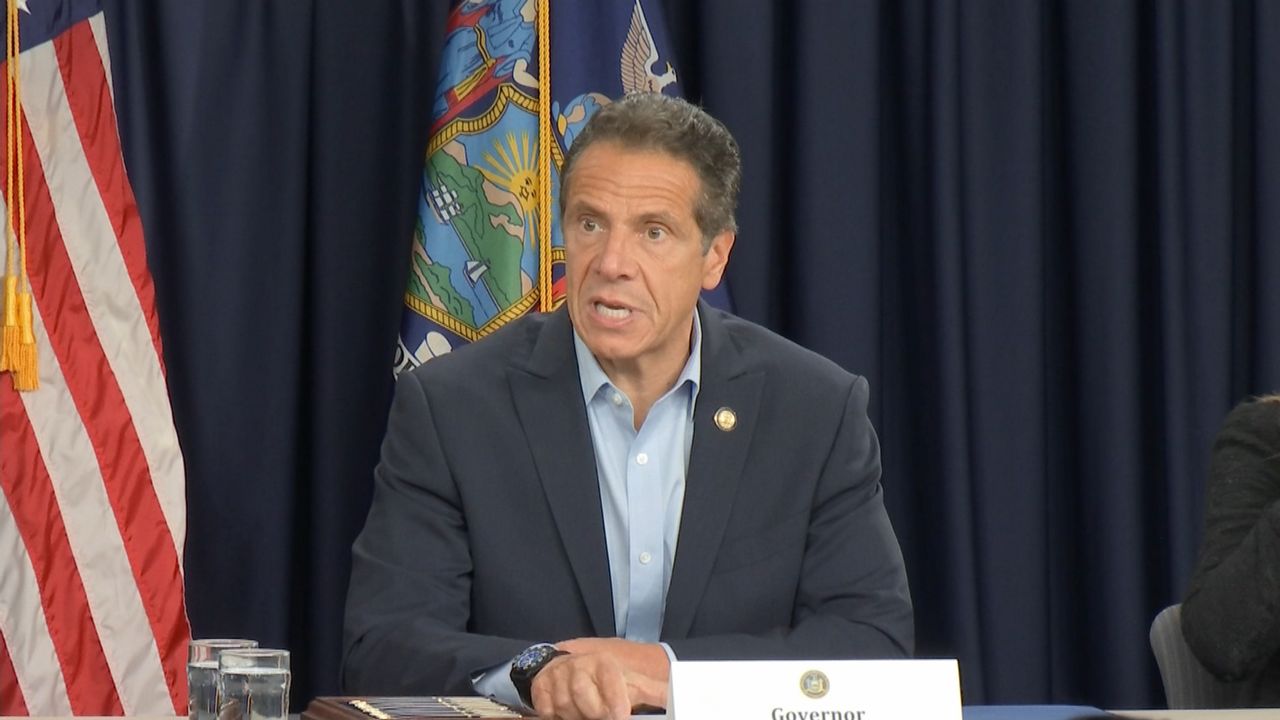

Debt collectors would be licensed by state insurance and banking regulators in a bid by Gov. Andrew Cuomo to crack down on abuse within the industry.

Cuomo on Thursday rolled out the latest State of the State proposal ahead of the Jan. 8 address addressing the debt collection industry. The move could affect the 1 in 4 New Yorkers who have had their debt subject to collections.

“New York is a national leader when it comes to taking on predatory debt collectors, but current law has allowed many bad actors to go unchecked,” Cuomo said.

“We license barbers, home inspectors and used car dealers in New York – so it makes no sense that we don’t have the authority to license an industry that can cause families financial ruin. As this industry grows and increasingly deploys abusive and deceptive practices to prey on consumers, this proposal would give the state new tools to regulate debt collectors – stopping unscrupulous practices and strengthening our consumer protection laws.”

Debt collection has come under scrutiny. It’s an $11 billion industry that critics contend relies on abusive and deceptive practices in order to collect on bills. Federal authorities in 2018 received nearly half a million complaints about debt collectors.