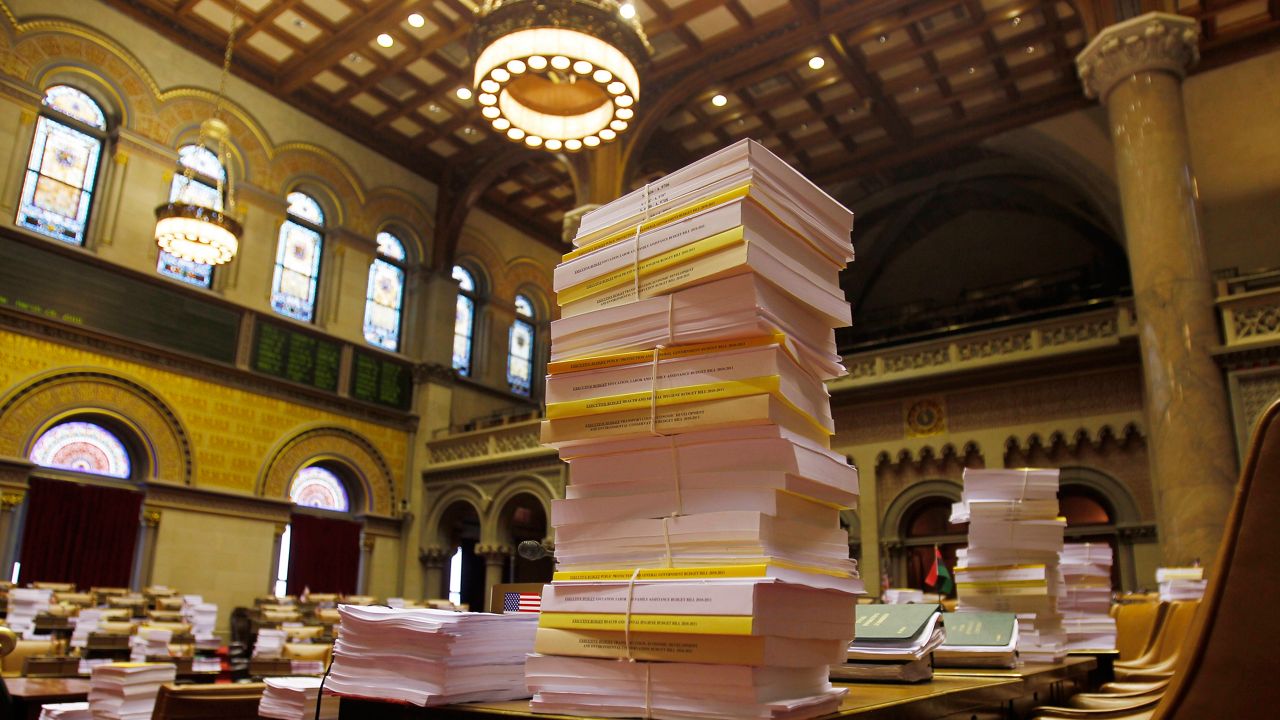

The New York State Legislature is on its way to finalizing the largest state budget in New York’s history totaling $212 billion. The money funds education and health care, and is meant to aid the state's economy in its recovery from the COVID-19 pandemic.

The budget raises taxes on upper income earners, and it generates more revenue with the legalization of mobile sports betting.

Here is how some of that money will be spent and where part of this revenue will come from:

Tax Increases on Top Earners and Corporations:

- New Yorkers making $1 million in annual revenue and joint filers earning more than $2 million in annual revenue would see their current state income tax rate rise from 8.82% to 9.65%.

- New Yorkers making between $5-25 million in annual revenue would see their tax rate increase from 8.82% to 10.3%.

- New Yorkers making more than $25 million would see their tax rate increase to 10.9%.

- The Corporate Franchise Tax Rate will increase from 6.5% to 7.25% for three years. Companies making less than $5 million in income will see their rate stay at 6.5%.

- The Capital Base Test will be reinstated at a rate of 0.1875%. This will exempt coops, manufacturers and small companies.

- Middle-class New Yorkers will see tax cuts:

- People filing jointly in $43,000-$161,550 income bracket will see their income tax rates lowered from 6.09% to 5.97%

- People filing jointly in the $161,550-$323,200 income bracket will see their income tax rates lowered from from 6.41% to 6.33%

Mobile Sports Betting:

- The Gaming Commission will issue a request for applications or RFA to at least two betting platforms and a minimum of four operators to solicit bids for licenses to conduct mobile sports betting in NY.

- Platforms which opt to partner with a Native American tribe or nation will be given additional points in the bidding/scoring process.

- The state will be issue a request for applications to platform providers by July 1. Applications will be due 30 days after.

- In order to receive a mobile sports wagering license, a platform provider would have to pay a one-time $25 million fee to the state. This money would be directed to the state lottery fund for education aid.

- This proposal is expected to increase education revenue by $99 million in SFY 2021-22, $357 million in SFY 2022-23, and reach $500 million in SFY 2025-26.

- $6 million annually will be dedicated to “problem gaming addiction treatment and resources.”

- It will also create a new “statewide youth sports activities and education grant program for underserved youth” under the age of 18, which will be funded annually at $5 million.

- The proposal to allow sports betting through on-site kiosks at tracks, stadiums, arenas, and some OTB parlors was not included in the finalized budget deal.

Excluded Workers Fund:

- $2.1 billion Excluded Worker Fund that will provide one-time unemployment benefits to undocumented immigrants who lost employment or income during the COVID-19 pandemic.

- This will be split into two tiers:

- Tier 1: Excluded Workers can receive $15,600 (calculated at $300 per week for 52 weeks). These workers must show a valid Individual Taxpayer Identification Number (ITIN), or a letter from an employer, valid pay stubs, W-2, and more.

- Tier 2: Excluded Workers can receive $3,200 (the same amount of federal stimulus payments) if they can certify their identity, residency and show alternative proof of work-related eligibility.

Education:

- State aid to school districts will increase to $29.5 billion, a $3 billion increase from the prior fiscal year.

- $1.4 billion Foundation Aid increase with a commitment to fully fund the state’s foundation aid formula over the next three years.

- $105 million expansion of full-day prekindergarten, providing pre-K funding to 210 districts who don’t currently receive state-funded full-day Pre-K.

Higher Education:

- Three-year tuition freeze for SUNY and CUNY.

- The maximum award under the Tuition Assistance Program (TAP) will increase by $500.

- Budget commits to eliminating the TAP gap in 4 years by setting up additional recurring operating aid to SUNY and CUNY.

- Restores $35 million in Bundy Aid to support private colleges and universities.

- Also restores $72 million in operating aid cuts to SUNY and CUNY.

Small Business Relief:

- $1 billion will be directed to support small businesses:

- $800 million for small business grants

- $200 million in small business tax credits

- $35 million Restaurant Return-to-Work Tax Credit.

Rent Relief and Protections:

- Finalized budget deal creates a $2.4 billion Emergency Rental Assistance Program to prove assistance to those impacted by the COVID-19 pandemic, regardless of immigration status.

- This includes payments for 12 months of back rent and utilities and three prospective months of rent.

- One year of eviction protection.

Infrastructure and Transportation:

- $350 million in transportation infrastructure investments

- Includes $100 million increase for CHIPS

- $100 million in new funding for Extreme Winter Recovery funding

- $50 million increase for PAVE-NY

- The finalized deal also creates a new fund the City Touring Routes Program and direct $1 million for highway and bridge projects.

Environment:

- Authorizes the $3 billion Environmental Bond Act of 2021, "Restore Mother Nature”

- However, the Bond Act will not appear on the ballot until the 2022 general election.

Health Care:

- Restores the $415 million in originally proposed Medicaid cuts

- Delays carveout of the Medicaid prescription drug benefit for two years

- Expands postpartum coverage for women on Medicaid from 60 days to one year.

Other Budget Nuggets:

- Early Retirement Incentive only applies to NYC employees.

- $40 million for non-profit arts institutions.

- $25 million for the Nourish NY program.